Enrolling in Medicare for the First Time: Your Simple Guide

Your journey with Medicare begins with the Initial Enrollment Period (IEP). This seven-month window includes:

- Three months before your 65th birthday

- The month of your 65th birthday

- Three months after your 65th birthday

What Happens If You Delay Enrollment?

If you have group health insurance through your employer or your spouse’s employer, you may qualify to delay enrolling in Medicare Part A and Part B without facing late enrollment penalties.

Exploring Your Coverage Options

- Once you apply for Original Medicare (Part A and Part B), you’ll have the option to choose additional coverage, such as:

- Medicare Advantage Plans (Part C): These are offered by private insurers and bundle your Part A, Part B, and often Part D benefits.

- Medicare Prescription Drug Coverage Plans (Part D): Standalone plans for medication coverage.

Pro Tip: Choosing the right plan during your IEP ensures you avoid gaps in coverage or late penalties.

Key Medicare Enrollment Periods Explained

Medicare enrollment offers various windows depending on your situation:

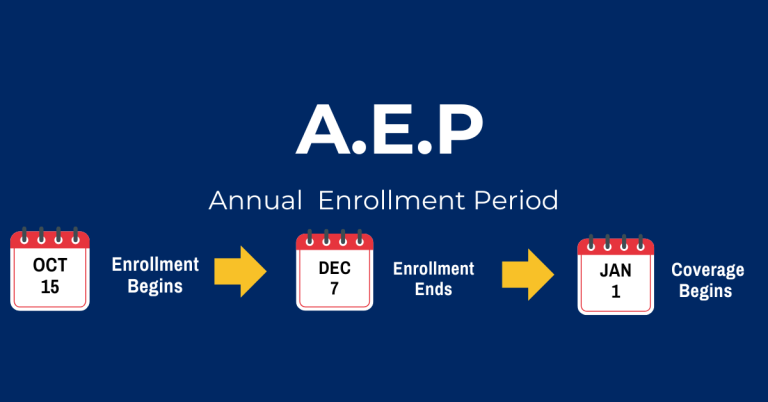

Annual Enrollment Period (AEP):

- Runs from October 15 to December 7 each year.

- You can enroll, change, or cancel your Medicare plan.

- The plan selected becomes effective on January 1 of the following year.

Medicare Advantage Open Enrollment Period (MA OEP):

- Runs from January 1 to March 31 annually.

- Available only to those already enrolled in a Medicare Advantage plan, allowing one plan switch.

Special Enrollment Periods (SEP):

Available for unique circumstances, such as relocating or losing employer coverage.

Why These Periods Matter

Making changes during these periods ensures you’re not locked into coverage that no longer meets your needs.

Making Changes During the Annual Enrollment Period

From October 15 to December 7, you can:

- Switch from Original Medicare to a Medicare Advantage plan (or vice versa).

- Add or drop Medicare Part D prescription drug coverage.

- Change between Medicare Advantage plans.

Special Enrollment Periods:

Unique Opportunities

Certain life events trigger a Special Enrollment Period (SEP), allowing you to make changes outside the usual windows.

Examples include:

- Moving to a new area with different Medicare plan options.

- Losing employer or union health coverage.

- Gaining eligibility for a new plan due to Medicaid or Extra Help.

Important Note: Always report qualifying life events promptly to avoid delays in coverage.

Final Thoughts:

Your Medicare Enrollment Checklist

To simplify the process, follow this checklist:

- Mark your IEP dates: Plan to enroll within your seven-month window.

- Review your coverage needs: Decide if you need a Medicare Advantage plan or additional Part D coverage.

- Keep track of deadlines: Note AEP, MA OEP, and any potential SEPs.

- Consult with an expert: Speak to a Medicare advisor for personalized guidance.

Enrolling in Medicare doesn’t have to be stressful. By understanding the timelines and making informed decisions, you’ll set yourself up for comprehensive coverage and peace of mind.

Have questions about Medicare enrollment? Feel free to give us a call and we will guide you.