What are Medicare Advantage Plans?

Step into the vast domain of *Medicare, as we unravel the intricate details and potential advantages of Medicare Part C. This distinct part, more commonly referred to as Medicare Advantage Plans, stands out by providing beneficiaries with expanded, and in some instances, enriched healthcare coverage options.

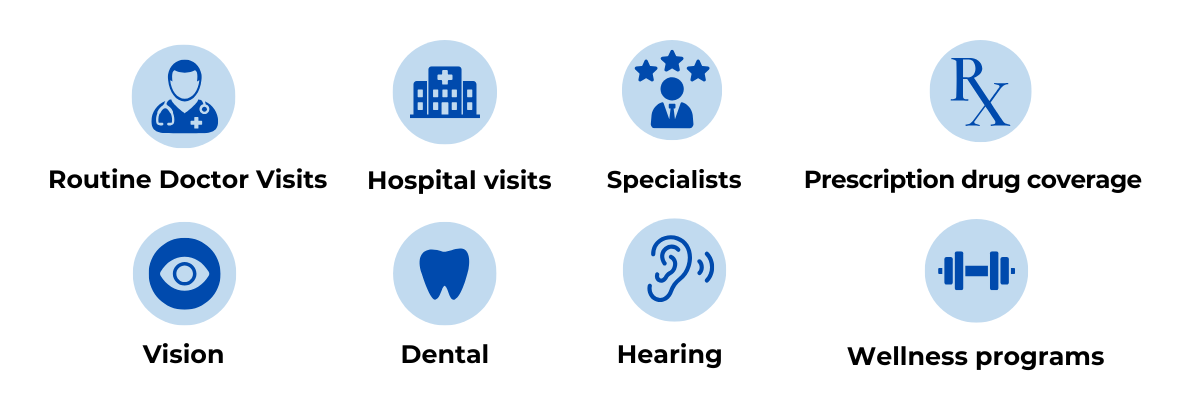

Medicare Advantage Plans (Part C) weave together the fundamental healthcare coverages of Original Medicare (Parts A and B) while often introducing a variety of additional benefits. Structured and provided by private insurance firms approved by *Medicare, these plans can encompass:

➔ Inclusive Coverage: The same benefits and services covered by Original *Medicare.

➔ Extended Benefits: Potential additional coverages like dental, vision, prescriptions and or hearing care.

➔ Network Restrictions: Encompasses specified doctors and healthcare providers.

Navigating the Coverage Network

Choosing Medicare Advantage means it becomes your primary healthcare coverage, necessitating a solid understanding of:

➔ Network Utilization: Using healthcare services within your plan’s network to minimize costs.

➔ Out-of-Network Costs: Potential higher out-of-pocket expenses for utilizing out-of-network services.

➔ Emergency Services: Often cover ed, even outside of the network. * At a cost

A Financial Overview

While they often offer alluringly lower premium structures, the financial aspect of Medicare Advantage Plans is multifold, involving:

➔ Premium Costs: Often lower than Original *Medicare

➔ Part B Premiums: Consistent payment of Part B premiums is typically required. (Some Medicare Advantage plans may assist with payments .

➔ Additional Costs: Potential copayments, coinsurance, and deductibles.

➔ Maximum Out-of-Pocket Costs: Most plans have a capped annual out-of-pocket amount.

Choosing a Medicare Advantage Plan necessitates a blend of understanding your healthcare requirements and judicious financial planning. While the comprehensive coverage and additional benefits can be significantly advantageous, each plan needs to be scrutinized to ensure it aligns seamlessly with your individual healthcare needs and financial situation.

Copyright © 2024 | All rights reserved | 828 S. Military Trail, Deerfield Beach Florida, 33442.