Quick takeaway

Medicare Part C—commonly called Medicare Advantage—is coverage offered by Medicare-approved private insurance companies. These plans provide everything Original Medicare covers (Part A + Part B) and may include additional benefits like dental, vision, hearing, fitness programs, transportation, or prescription drug coverage (depending on the plan).

What Is Medicare Part C? A Closer Look at Coverage

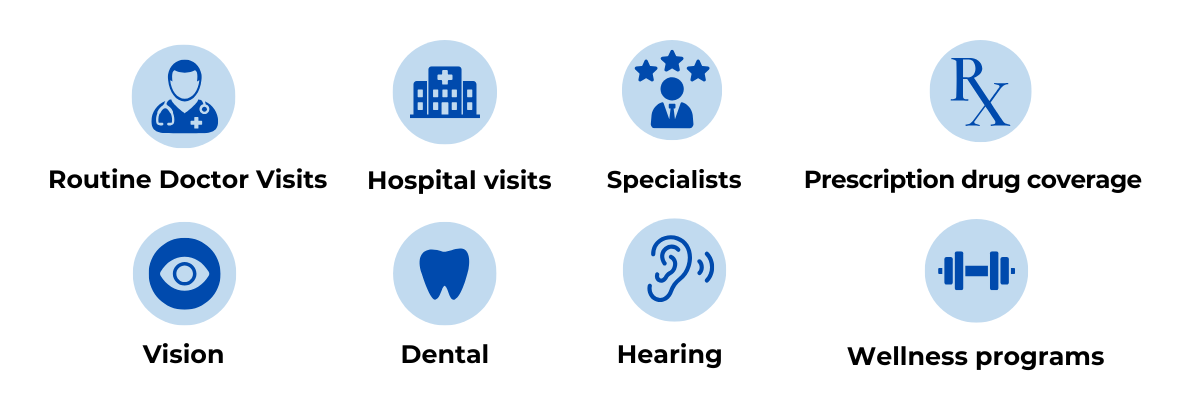

Medicare Advantage Plans (Part C) combine the foundational healthcare benefits of Original Medicare with additional services and structured plan networks. These plans typically include:

- Inclusive coverage: The same medically necessary hospital and medical services included under Original Medicare.

- Extended benefits: Many plans may include dental, vision, hearing, OTC allowances, or prescription drug coverage (MAPD).

- Provider networks: Most plans use networks (HMO/PPO). Costs are often lower when you see in-network providers.

While Medicare Advantage must cover everything Original Medicare covers, plan rules and costs vary. Understanding how Part C works helps you identify which plan best matches your healthcare needs and budget.

Understanding Medicare Advantage Coverage

Medicare Advantage plans must provide at least the same level of coverage as Original Medicare, but they can structure costs and benefits differently. Deductibles, copays, premiums, and provider rules vary by plan, so it’s important to compare options carefully—especially if you regularly visit doctors or specialists.

Common Features of Medicare Part C Plans

- Network-based care: HMOs and PPOs generally use networks; some may require referrals.

- Annual out-of-pocket maximum (MOOP): Unlike Original Medicare, Part C includes a yearly cap on Part A/B costs.

- Bundled benefits: Many plans include drug coverage and extra wellness benefits, depending on plan design.

Reviewing a plan’s network, covered services, and cost-sharing before enrolling helps you understand how the plan may fit your needs throughout the year.

Speak to a Licensed Sales Agent

Want help comparing Medicare Advantage plans in your county—including networks, benefits, and expected costs? We’ll walk you through options clearly and answer your questions.

Who Is Eligible for Medicare Part C?

You may be eligible to join a Medicare Advantage plan if:

- You are enrolled in both Medicare Part A and Part B

- You live in the plan’s service area (county-based availability)

- You meet plan eligibility rules (some exceptions apply depending on circumstances)

Plan availability differs by county and carrier, so it’s important to confirm which plans operate where you live.

Financial Basics of Medicare Part C

Medicare Advantage costs vary by plan. When comparing options, pay attention to:

- Plan premium: Some plans may have a low or $0 monthly premium.

- Part B premium: You typically still pay your Medicare Part B premium.

- Copays/coinsurance/deductibles: These depend on plan design and services used.

- Maximum out-of-pocket (MOOP): Once reached, the plan covers 100% of covered Part A/B costs for the rest of the year.

Understanding these costs helps you estimate yearly spending and compare plans more confidently.

Checklist for Medicare Advantage Enrollment

- Confirm your enrollment window: IEP, AEP, MA OEP, and any SEPs.

- Check provider networks: Make sure doctors and hospitals are in-network.

- Review prescriptions: Verify drugs are on the plan formulary and preferred pharmacies are included.

- Compare total costs: Look beyond premium—copays, deductibles, and MOOP matter.

- Ask questions: Get clarity on referrals, authorizations, and benefit limits.

Medicare decisions don’t have to be overwhelming. A clear comparison of benefits, costs, and doctor access can help you enroll with confidence.