How Do Tricare and Medicare Work Together?

With so many changes to healthcare happening lately, it takes time to keep up with what’s covered and what needs to be covered. Tricare and Medicare are two government-sponsored health insurance programs that work together to provide coverage for American citizens. Both programs have their own eligibility requirements, benefits, and providers, but beneficiaries who are eligible for both programs can use them to help pay for their healthcare costs. But how do they work together? Let’s take a closer look.

What is Tricare and How Does it Work With Medicare Coverage?

Tricare is a health insurance program for active duty and retired military personnel, their families, and survivors. It is administered by the Defense Health Agency (DHA) and is intended to supplement the coverage provided by the Veterans Affairs (VA) healthcare system. Tricare provides coverage for various health care programs and services, including preventive care, hospitalization, doctor’s visits, and prescription drugs.

Tricare works with Medicare coverage to provide comprehensive healthcare coverage for eligible beneficiaries. Beneficiaries who are eligible for both programs can use Tricare in combination with Medicare to help pay for their healthcare costs.

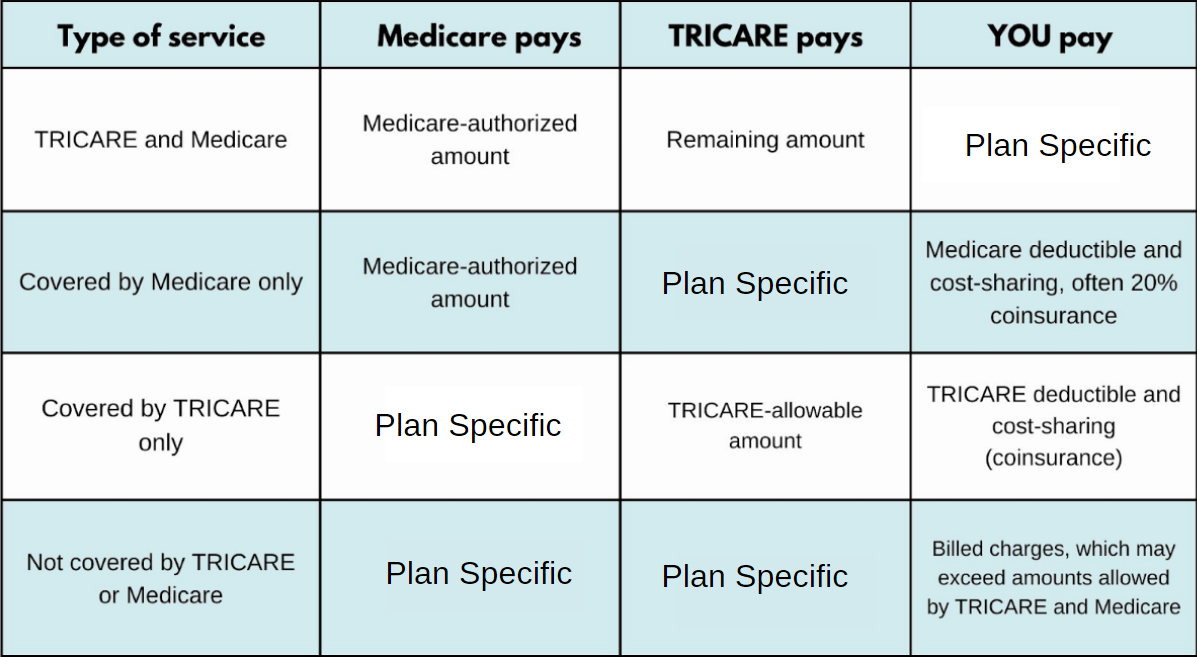

For those who are qualified for Medicare, Tricare works as a secondary payer after Medicare, which means that Medicare pays first, and Tricare pays any remaining charges. If the beneficiary is not Medicare eligible, Tricare will be the primary payer.

Beneficiaries should also be aware that not all providers accept both Medicare and Tricare, so they should verify with their provider if they accept both insurances; if not, they might have to look for a different provider or pay out of pocket.

It’s important to understand that Tricare is designed to supplement, not replace Medicare coverage, and Tricare covers Medicare; Tricare works as a secondary payer after Medicare, meaning additional benefits or covers gaps that Medicare does not cover such as chiropractic care and acupuncture, also coverage for long-term care services like nursing homes.

Beneficiaries should be aware of the costs associated with their creditable coverage and consult their local Tricare Service Center or their regional contractor to ensure that they understand how Tricare works with Medicare and how to make the most of their coverage.

Are There Any Benefits to Having Both Medicare and Tricare for Life?

For those who qualify, having both Medicare and Tricare for Life (TFL) can be a great option to have full coverage over their health. For example, Medicare covers routine care like flu shots and preventive cancer screenings at no cost. At the same time, TFL is excellent for emergency care, such as ambulance services or other treatments not covered by Medicare.

TFL acts as a “secondary payer” to Medicare, meaning that it will cover some of the out-of-pocket expenses, such as copayments and deductibles, that Medicare does not cover. In addition, TFL provides coverage for some healthcare services that Medicare does not cover, such as some types of occupational therapy and prosthetic devices. So, if you are eligible for both programs, you can use TFL to supplement the coverage provided by Medicare, potentially reducing your out-of-pocket costs for health care.

Additionally, TFL is especially beneficial for retirees living overseas, as Medicare does not cover services outside of the U.S. When both Medicare and TFL are combined, certain services may be provided at no additional cost that must be obtained from an external source. All in all, having both Medicare and TFL is a great way to ensure maximum coverage and reliability within any medical situation.

What Do Medicare and Tricare for Life Pay on Drugs?

Medicare and Tricare for Life provide coverage for prescription medications. Tricare For Life helps cover Medicare Part B expenses, as well as out-of-pocket costs such as deductibles and coinsurance. Eligible beneficiaries include those who are 55 years of age or older and enrolled in Medicare Part A and Part B.

With both Tricare for life and Medicare, payment is fairly straightforward: Tricare for life covers the deductibles, copays, and coinsurance required by Medicare; Tricare for life also pays for any additional charges Medicare does not cover. All eligible prescriptions will be paid at Tricare’s standard approved rate, and Tricare pays all eligible charges up to this limit.

Both Tricare for life and Medicaid also provide access to selected generic medications at a discounted rate, saving patients’ out-of-pocket expenses on brand-name drugs and helping to control rising healthcare costs. If you have questions on Medicare and TRICARE eligibility, contact us!

Can People Who Have Tricare and Medicare Receive Dental and Vision Coverage?

Tricare is a health insurance option for people in the US military, while Medicare is a federal health insurance program that all Americans can take advantage of as they age. Because Tricare is designed to supplement Medicare, many people wonder if there are dental and vision coverage options with Tricare and Medicare.

The answer depends on whether you have Tricare For Life and Medicare Advantage plan. With Tricare For Life, you’ll receive coverage for dental and vision procedures that original Medicare doesn’t cover. With a Medicare Advantage plan, you will tend to find more extensive coverage for vision and dental care, often including routine preventative check-ups. Therefore, Tricare and Medicare each provide different levels of dental and vision coverage depending on the type of plan used.

Does Medicare Automatically Bill Tricare for Life?

Deciding which Tricare and Medicare Advantage plans to have serviced by Tricare for life can be confusing. While Tricare and Medicare may have some similarities, Tricare is separate from Medicare; thus, Tricare does not receive automatic medical bills. Medicare recipients will need to contact their Tricare plan to find out if they are eligible for Tricare coverage, as well as which services are covered under their particular Tricare policy and plan.

Tricare for Life offers special coverage for an additional premium, making it an appealing option for those seeking supplemental coverage after standard Medicare abides by its limit on hospital stays or other medical care items. It is always wise to assess all Medicare Tricare benefits carefully before committing to any Tricare or Medicare policy variant in order to ensure the best quality of care.

What is the Coverage of Medicare and Tricare for Life?

Medicare and Tricare for Life (TFL) provide health care for individuals over the age of 65 or those who are permanently disabled. Medicare is a federal program administered by the Centers for Medicare and Medicaid Services and provides coverage for hospitalization, physician office visits, home health visits, and mental health services.

TFL extends Medicare coverage, providing even more support to eligible Medicare recipients, including additional benefits such as hearing tests, vision exams, and corrective lenses. While Medicare typically covers only 80 percent of approved charges, TFL pays the remaining 20 percent after Medicare’s deductible has been met.

Medicare and Tricare for life coverage options and benefits are different.

Medicare is a federal health insurance program that is primarily for people who are 65 or older, or who have certain disabilities or conditions. It has several different parts, including:

- Part A: Hospital insurance, which covers inpatient care in hospitals, hospice care, and some home health care.

- Part B: Medical insurance, which covers doctor services, outpatient care, and some preventive services.

- Part C: Medicare Advantage plans, which are offered by private insurance companies and provide additional coverage, such as prescription drugs and benefits like vision, hearing, and dental.

- Part D: Prescription drug plan coverage, which is optional and can be added to a person’s Medicare coverage.

Tricare, on the other hand, is a health insurance program for military personnel, retirees, and their families. It has different plans, including:

- Tricare Prime: Comprehensive coverage that typically requires the use of in-network providers and includes a low or no cost-sharing.

- Tricare Select: This is a fee-for-service plan where the enrollee will have cost-sharing for most services.

- Tricare Reserve Select: Limited coverage for reserve members and their families.

- Tricare Retired Reserve: Coverage for retired reserve members who are not yet eligible for Medicare.

When a person has both Tricare and Medicare, Tricare is typically the secondary payer; Medicare is the primary payer. This means that Medicare will pay for covered services first, and Tricare will then pay for any remaining covered services. But as mentioned earlier it is not automatic, you should check your coverage and know your own specific situation, and always notify your provider or health insurer to avoid potential errors.

How To Use Tricare and Medicare Together?

Using Tricare and Medicare together can provide you with extended coverage to meet all your medical needs. Tricare for Life is designed to seamlessly integrate Tricare and Medicare standards of care so that you can use Tricare as a supplement to your Medicare coverage.

Additionally, if you have enrolled in a Medicare Advantage plan, you can also link Tricare coverage to it to extend the scope of your medical insurance coverage even more.

Overall, Tricare and Medicare are meant to function as partners, providing you and your family members with access to the best health services while ensuring that all gap-related fees or premiums are minimized or avoided altogether.

Do I Have to Get Medicare at 65 if I Have Tricare?

Deciding between Tricare and Medicare under 65 can be confusing. It’s important to become familiar with both options before making a decision. If you are a military retiree, you do not have to enroll in Medicare at 65 if you have Tricare coverage.

However, it may still be in your best interest to do so, as Tricare coverage is generally secondary to Medicare coverage. This means that Medicare will pay for covered services first, and Tricare will pay for any remaining services.

Having both Tricare and Medicare could provide you with better coverage, particularly in cases where Tricare doesn’t cover a certain service or item. That being said, if you are already on the Tricare program and you want to continue with Tricare and don’t want Medicare, you can choose not to enroll in Medicare Part B when you first become eligible.

But keep in mind that if you choose not to enroll in Medicare Part B when you are first eligible, you may have to pay a late enrollment penalty when you decide to enroll later, also you may have gaps in coverage and delayed access to certain services.

It’s important to weigh the pros and cons of enrolling in Medicare, even if you have Tricare coverage, and to consult with a healthcare professional or a benefits counselor to understand your options and make an informed decision.

Thoughts

Tricare works with Medicare to ensure that beneficiaries have access to comprehensive care. Tricare fills in the gaps left by Medicare coverage, such as prescription drugs and long-term care. Although there is some overlap between the two programs, Tricare and Medicare provide different benefits for enrollees. Tricare beneficiaries can use both programs to get the coverage they need. If you’re eligible for both programs, please make sure to enroll in both to take advantage of all the available benefits.